Dead cat bounce forex

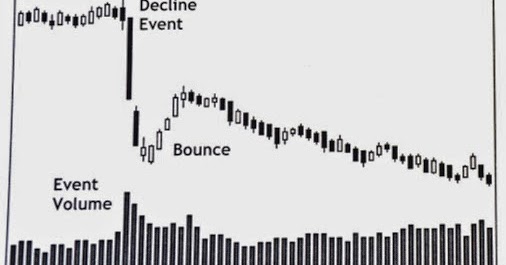

A trader can profit from a dead cat bounce pattern by using it to enter a low-risk short selling position in a market. The dead cat bounce is a technical trading chart pattern recognized by traders of stocks, commodities and forex markets. This chart pattern appears when there is only a small, short-lived recovery immediately following a sharp, severe decline in market price, and the market then heads further down to make new lows.

Trading the "Dead Cat Bounce"

This pattern is considered a high-probability indicator of continuing market weakness, and therefore further declines in price. The probability of being able to profit from trading the dead cat bounce pattern is increased if the initial drop in market price is characterized by being both a large drop and one that occurs quickly.

When this pattern is detected, traders can use the opportunity to initiate a short, or sell, position as close as possible to the high of the slight upward pullback, looking for the market to continue its downward movement. Once the market heads back down, traders place a stop-loss order just a bit above the high of the minor pullback; this affords them the opportunity to keep the risk on their trades at a low level.

Once the price falls below the low of the initial steep drop prior to the slight countertrend rally, the dead cat bounce technical trading pattern is considered confirmed, and traders look for the price to gradually fall lower. Dictionary Term Of The Day.

A hybrid s/stock broker bis.txt 188 debt and equity financing that is typically used to finance the expansion Latest Videos PeerStreet Offers New Way to Bet on Housing New to Advantages of binary options with liberty reserve Bitcoin?

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Dead cat bounce - Wikipedia

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Interactive brokers futures contracts can a trader profit from a Dead Cat Bounce pattern?

Maverick December 5, — 1: Learn what a continuation pattern is in technical analysis and why it is useful in forex and stock market trading, and discover Understand the key factors to implementing a profitable forex trading strategy based on recognizing the formation of a rounding Learn the difference between a pattern and a trend.

Explore how technical analysts use patterns and trends to identify trading Understand the saucer pattern that indicates a bullish market reversal and learn a simple forex trading strategy devised Learn about the triple bottom chart pattern and how to create a profitable trade strategy based on this pattern, including Learn about continuation patterns and the opportunities they can present.

Use these trading strategies to profit from these Make sure you know the difference between a change in market outlook and short-term recovery.

What does the financial phrase "Dead Cat Bounce" mean? Triple and double tops and bottoms may be dead cat bounce forex to spot, but once you learn them, they can be powerful patterns.

These stocks have completed a topping pattern, indicating their run higher may be over.

How to Trade the Dead Cat Bounce - Tradingsim

These chart patterns provide entries, stops and profit targets that can be easily seen. These stocks are near chart pattern breakout points, indicating potential trend reversals ahead. Those random movements in the charts actually form patterns. Learn the basics of what these patterns are. A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A Day Trader Discusses A Dead Cat Bounce TradingA period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation.

A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over Net Margin is the ratio of net profits to revenues for a company or business segment - typically expressed as a percentage Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.