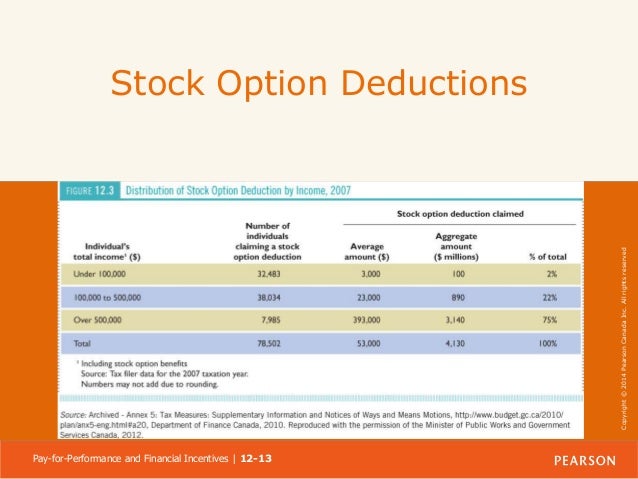

Canadian stock option deduction

Please contact customerservices lexology. The newly elected Liberal government indicated in its election platform that it intends to increase taxes on employee stock option benefits by limiting Canadian resident employees from claiming the stock option deduction i.

However, this fails to account for the fact that employers generally forgo a tax deduction where employees are entitled to the stock option deduction. It is hoped that the new government will carefully re-evaluate the proposal having regard to the overall impact of implementing any limitation to the stock option deduction, and that it will also consider the significant value it provides employers in incentivizing their Canadian employees.

Taxation of Employee Stock Options | Collins Barrow | Chartered Professional Accountants

However, in the meantime, we are in a period of significant uncertainty because it is unclear what changes, if any, the government will enact and, if the government proceeds with implementing a limitation on the stock option deduction, whether there will be any grandfathering for existing options. Upon exercising a stock option to acquire a share, a Canadian resident employee has an employment benefit equal to the difference between the fair market value of the share and the option exercise price.

In the case of a stock option issued by a Canadian-controlled private corporation, the taxation of the employment benefit is deferred until the underlying share is sold.

Taxation of Stock Options for Employees in Canada

Where the stock option is cashed out, the employment benefit is equal to the cash payment received. Stock options issued to Canadian resident employees are typically structured to meet the conditions that entitle employees to the stock option deduction. Canadian employers are not entitled to a deduction for tax purposes in respect of the shares issued on the exercise of stock options.

In addition, as a result of amendments in , employees are only entitled to the stock option deduction on the cash-out of stock options where the employer files an election stating it will not deduct such payment for tax purposes.

An employer is thus generally forgoing a deduction by implementing a compensation plan that allows employees to claim the stock option deduction. Most employers consider this appropriate because stock options generally have no in-the-money value on the date of grant and provide no assurance that the employees will ever receive any benefit under the stock options.

In addition, the employer can increase the potential economic upside to the employee, thereby creating greater alignment with the employer's goals. The stock option deduction also provides the employees with similar tax treatment to that of the equity holders of the employer.

A starting point would be to set a cap on how much can be claimed through the stock option deduction. Currently, employees generally have an incentive to defer exercising their vested options so that they do not trigger the employment benefit until there is an intention to sell the underlying shares and, in the case of an employer that is not a Canadian-controlled private corporation, an obligation to pay the tax in respect of such benefit.

Moreover, where an employee does not intend to immediately dispose of the shares, the employee will have a capital loss if the shares subsequently devalue and the capital loss cannot be used to offset the employment benefit that was triggered on the exercise of the options.

However, in many cases, employees will not have this option because of vesting limitations and, in the private company context, not having a market in which to sell the shares. In addition, the increase in revenue to the government that the platform suggests would be achieved would likely be offset to some extent by employers restructuring their stock option plans to get a deduction for benefits provided to their employees.

At this time, it is unclear if and when the government may seek to limit the stock option deduction and, if it does, what the scope of any such limitation will be.

If the government does proceed with any such measures, it is possible that they could become effective on the date they are announced. In addition, while we would hope there would be some grandfathering for existing stock options, it is uncertain whether this will be the case. As a result, employees that are potentially affected by any such limitation should carefully weigh their alternatives including having regard to the proposed increases in personal tax rates , and employers that are considering granting options may consider accelerating such grants in case any new proposal provides grandfathering for existing options.

If you are interested in submitting an article to Lexology, please contact Andrew Teague at ateague GlobeBMG. I love the newsstand! Jason T Weintraub Director, Legal Taco Bell.

We use cookies to customise content for your subscription and for analytics. If you continue to browse Lexology, we will assume that you are happy to receive all our cookies. For further information please read our Cookie Policy.

Newsfeed Navigator Analytics Track Discover. Share Facebook Twitter Google Plus Linked In.

Canada – Quebec Bumps Up Stock Option Deduction | KPMG | GLOBAL

Follow Please login to follow content. Register now for your free, tailored, daily legal newsfeed service.

Will tax treatment for Canadian stock options change? Canada October 29 The Stock Option Deduction Upon exercising a stock option to acquire a share, a Canadian resident employee has an employment benefit equal to the difference between the fair market value of the share and the option exercise price. Treatment to the Employer Canadian employers are not entitled to a deduction for tax purposes in respect of the shares issued on the exercise of stock options.

Comments on the Proposed Limitation of the Stock Option Deduction The Liberal platform stated: What Should You Do? To view all formatting for this article eg, tables, footnotes , please access the original here. Popular articles from this firm Shareholder activism and proxy contests: Suspension of Private Relief: To Go or Not to Go? IRS Issues Broad Disclosure Rules for Foreign-Owned Disregarded U. Arbitration Canada USA India More Back to Top RSS feeds Contact Submissions About.

Testimonials Cookies Disclaimer Privacy policy. Login Register Follow on Twitter Search.