777 fibonacci binary options strategy

Fibonacci Strategy for Binary Options Trading. The reason why it is preferred to use the Betonmarkets platform for this strategy is as follows:. Being able to choose your own expiry time affords you some flexibility to play around with. This strategy is played out on a daily chart where the trade outcome is not very obvious. For the Fibonacci strategy, we will use the daily chart for our analysis. The concept behind this strategy is to identify areas to which the price of the asset will retrace to after a particularly strong trend.

The only way to get the trend of the asset is to watch its price behaviour over a length of time, and this can only be done using the daily charts. Using the Fibonacci strategy tool http: How is the Fibonacci retracement tool used?

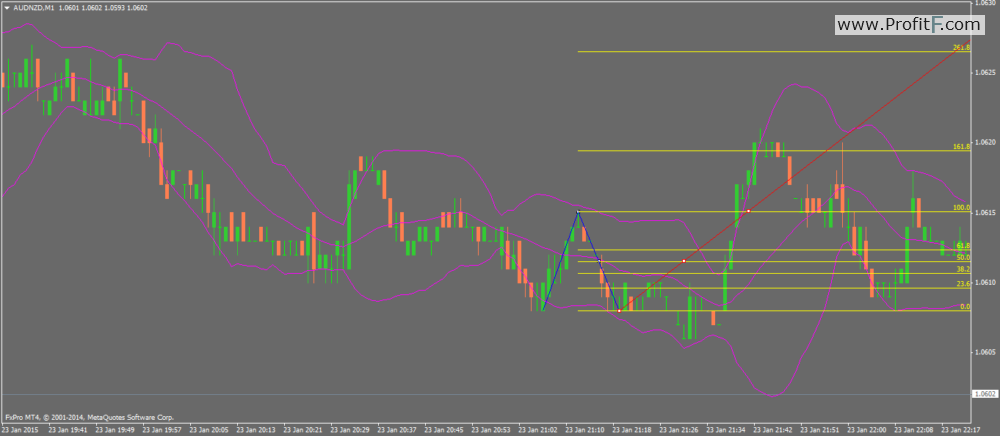

In an uptrend, this is done by tracing from the lowest point that the price has made on the chart swing low to the highest point that the price has made on the chart swing high. When this has been done by the trader, the five levels of Fibonacci retracement will appear as follows: Once the trace with the Fibonacci tool has been made, the next question is: Personal research has shown the Stochastics oscillator is a useful tool in this regard.

Fibonacci Strategy for Binary Options Trading and Profitability

By crossing at oversold levels in a downward retracement, a trader can pinpoint at which Fibonacci retracement level the retracement of the asset will come to an end, and the move in the previous trend resumes.

Similarly, in an upward retracement, the Fibonacci crossing forex haram atau tidak an overbought level will show the trader where the asset will end its retracement in order to resume the downtrend.

The snapshot below demonstrates these points:. From this information, it is obvious that the following retracement levels can be used as price targets for the Touch trade:.

The expiry for this trade 777 fibonacci binary options strategy not be less than 7 days since the analysis is done on a daily chart. More often than not, this level will be breached or will at least form the area where the retracement will end, confirmed by ken calhoun forex cross of the Stochastics indicator.

If the cross happened at the For the No Touch trade, wait until the Stochastics oscillator has crossed at a Fibonacci level before setting a NO TOUCH price target. If the cross is at an oversold region, use a price target below that Fibo level for the trade. If the cross was at an overbought region, use a price target above that Fibo level for the trade. Sorry for my english…. You must be logged in to post a comment.

BinaryULTRA - Binary Options Courses

It is a long term strategy that can produce a huge payout. The reason why it is preferred to use the Betonmarkets platform for this strategy is as follows: Let us now give a description of the strategy.

The snapshot below demonstrates these points: Using a Fibonacci Strategy to Trade Binaries. More posts to check out: Three Ducks Trading Strategy MACD and Parabolic SAR Strategy Double No-Touch Strategy Pivot Point Boundary Strategy.

Pivot Point Boundary Strategy. Candlestick Patterns for Binary Options. Leave A Reply Cancel reply You must be logged in to post a comment. Trading Strategies Trading Strategy Trading Tunnel Options Trading Double No-Touch Options Trading Nested Tunnel Options Trading Onion Options Second Strategies Capital Drawdown Strategy Commodity Stock Effect Trade Strategy Duke of York Strategy Correlation Coefficient Strategies.

Developed by Think Up Themes Ltd.