Fx digital option delta

Digital Option

When a new trade comes to the risk manager in a bank for approval, he tries to determine both the quality and the quantity of the risks inherent in the trade. If he's not comfortable with either of the two, he may not approve it. Some of the factors that are considered are: Whether the bank has a model to price and determine the risk of the trade.

And yes it happens, with virtually any payoff possible in the OTC equity derivatives markets, the bank will not always have the model to handle the trade. Number of underliers to the trade and whether these underliers are liquid indices or thinly traded stocks. Managing the risks of a multi asset trade with illiquid stocks as undeliers would be the most difficult.

FXG C/Assembly Add-Ins - omenejomy.web.fc2.com File Sharing

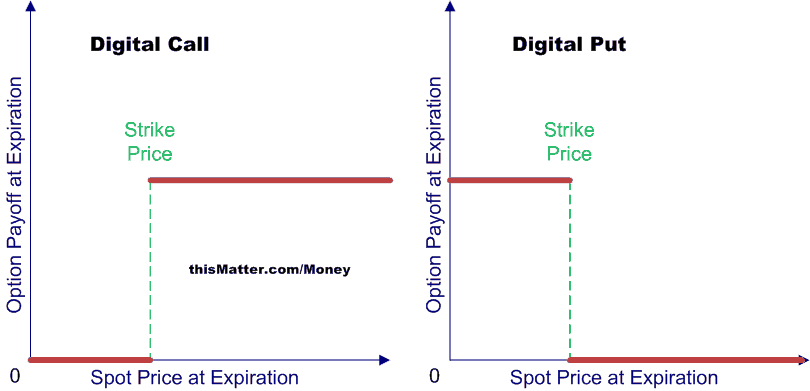

Discontinuities in the payoff. The greeks-delta and gamma in general as the spot approaches the barrier become extremely volatile.

Ofcourse, Not all trades require pre approval esp. For new payoffs the trader will come up wth an overall hedging strategy for the trade. Often the most important aspects of the hedging strategy revolves around managing greeks around discontinuities or barriers. In this article, I shall talk about 'Overhedging' which is a technique to handle effectively risks around barriers.

What the trader achieves by doing so is a smoother set of greeks specially the delta. As an example let's consider a binary option in the figure below booked as a call spread. It's important to note that the call spread is structured that it is more expensive than the original binary option.

What this means is that when a buyer comes to a bank with a price request for a digital option, the bank actually quotes price for a call spread. To extend the discussion to the barrier trades, a barrier trade can be viewed as a combination of an option spread and an option.

For example an up and in call option can be booked and hedged as a combination of a call spread with strikes being barrier and barrier - overdhedge and a call option with strike equal to the barrier level.

A physicist thinks reality is an approximation to his equations. A mathematician doesn't care. Managing risks of Digital payoffs - Overhedging 3. I have my own problems to solve. I'm never likely to go there. I am just short the profit at the moment.