Best money market fund philippines

Access Denied

If you already know how UITFs work, skip straight to the top five equity UITFs you can invest in from P1, and up. But if you want to learn more about the basics, read on. Each UITF has its own Declaration of Trust which tells you how the fund is governed.

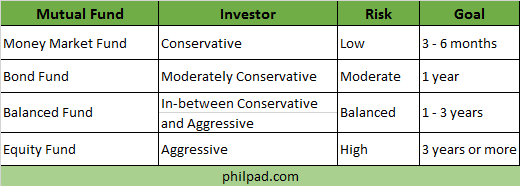

The most common types of UITFs are: Money market and fixed income UITFs are more conservative, while balanced is, well, more balanced.

Equity UITFs invest in equities listed in the stock exchanges hence the name.

Your investment is tied to the performance of the Philippine Stock Exchange as a whole and not just one company. Most of these equity UITFs use the Philippine Stock Exchange as their benchmark aiming to outperform it , so if the market is doing well, your investments should be doing even better. The dark blue line is the fund, and the yellow line is the PSE index.

This value reflects the market prices of the underlying stocks. NAVPU is recalculated daily.

This means you get 5, units, and you get a certificate saying so. But if the NAVPU went down and is now only P1.

Philippine UITFs You Can Invest In From P1, And Up

If this is the case, you should wait until the NAVPU has recovered. After that, just have the minimum initial investment required on hand, and you can start investing.

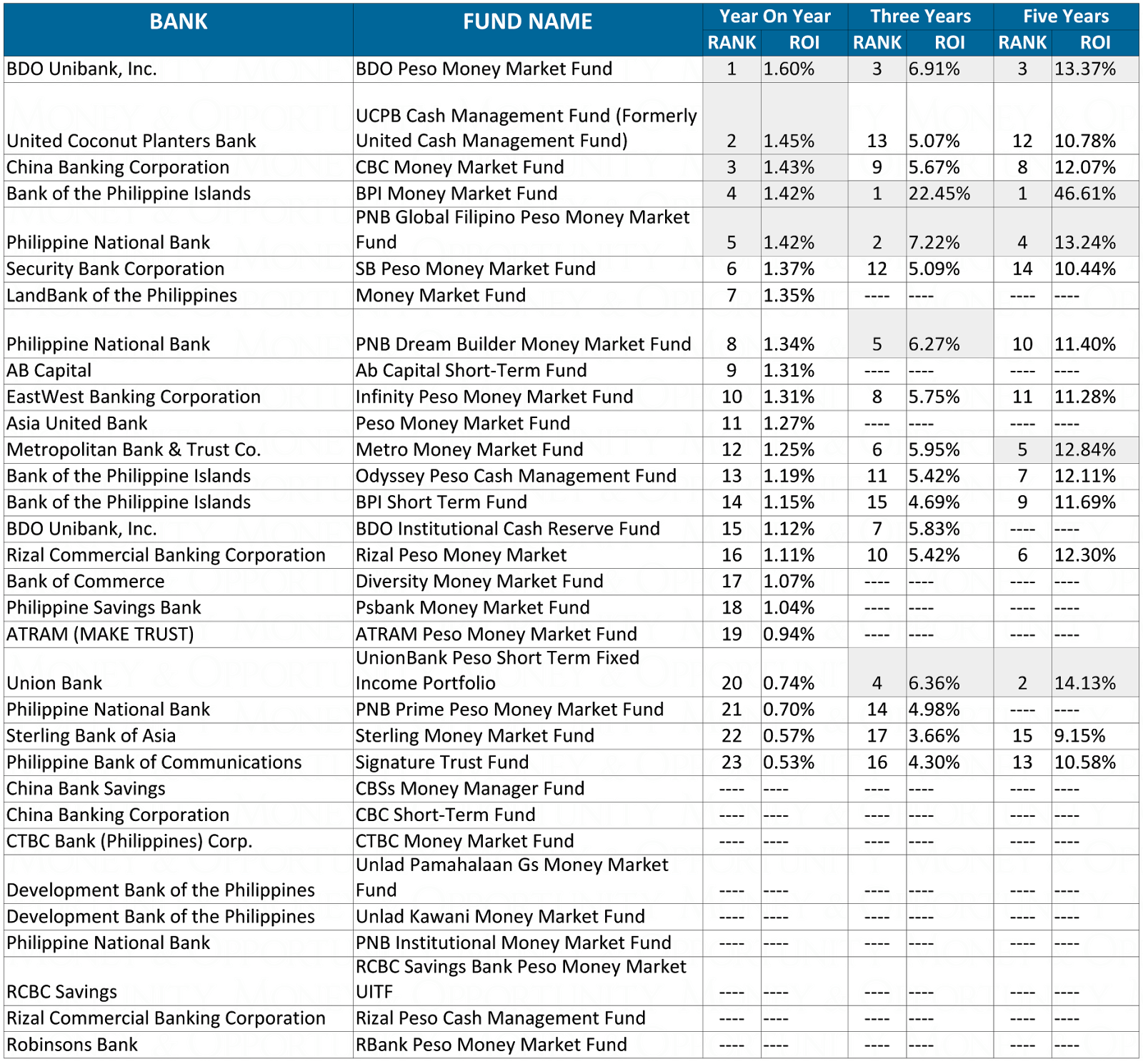

Money Market Funds in the Market - MoneySense Personal Finance Magazine of the Philippines

While past performance does not guarantee future returns, you should look at the medium-term performance of UITFs over the last three years to help you decide. And when the time comes to choose a UITF to invest in, go with the one that most matches your risk appetite and looks set to provide you with the best returns based on historical performance. All Categories All Categories Close.

Latest Articles Go to iMoney.

Best place to save money: Your options - Money Saving Expert

Philippine UITFs You Can Invest In From P1, And Up January 26, Investment , Money Management , Most Popular Articles. Share Tweet Email WhatsApp.

What types of UITFs are there? How does it work? How do you participate in a UITF?

Which equity UITFs should you choose? Security Bank Peso Equity Fund Initial investment: P5, if over P5,, should be in increments of P1, Holding period: May redeem units on the 31st calendar day for settlement on the 34th calendar day ROI Jan 5, to Jan 5, Share this article Share this! Best Credit Cards in the Philippines 8 Best Business Ideas In The Philippines For Peso-Cost Averaging: The Easy Way To Invest 8 Step Guide in Building a Retirement Plan.

How Do You Design Your Success Story: According to Francis Kong Part 3.

How To Recognize Your Potential For Success: According to Francis Kong Part 2. How Do You Climb The Mountain Called Success: According to Francis Kong Part 1.

Our Most Popular Posts Top 10 Highest Paying Jobs in The Philippines In , 13 Things You May Not Know About The SSS Fund , 8 Purchases You Should Only Make on Installment , The Key Differences Between a Commercial Bank, SSS, and… , Choosing The Best Internet Service Provider In The… , Get money saving tips!