Can you buy options in tfsa

Jump to main navigation Jump to main content. Last updated Tuesday, May 02, 6: Patience and perseverance will fix that. Introduced in , TFSAs have already become a great Canadian institution. Your investment gains are tax-free, and so are withdrawals. There are implications here for a federal government that is struggling with deficits in the near term thanks to an underperforming economy and faces the long-term challenge of an aging population that will slow future growth.

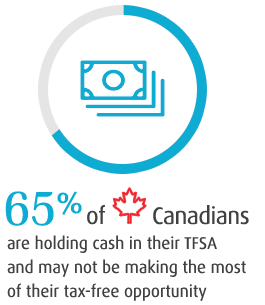

Canada Revenue Agency says there were In monitoring the balances in these accounts, CRA has found some in the million-dollar range. Aggressive stock trading is how this money was made.

Do not try this at home. Instead, your million dollar TFSA will be built through a disciplined approach that puts stock market risk to work in a controlled way see sidebar. You will not be day trading and swinging for home runs. In fact, an aggressive approach is likely to draw the attention of CRA as part of its efforts to identify professional stock traders using TFSAs to avoid paying taxes on gains made through a trading business.

The CRA spokesman said the factors the agency looks for with TFSAs are high dollar amounts, a high volume of trading transactions and incorrect valuation of the assets in the account. A key step in building a million-dollar TFSA is to contribute the maximum every year.

One is your investment approach. The sample investment portfolio provided here to help you build a million dollar TFSA assumes a 5. For that, you must invest mostly in stocks. The oldest financial advice in the world is to start young as an investor, but we have to be realistic about this. The stock markets are one risk to achieving a million-dollar TFSA. Recent days remind us how there are unavoidable short-term setbacks on the way to long-term gains.

The foregone revenue from having this money compound tax-free in TFSAs is significant, but Prof. The optics of million-dollar TFSAs may not be. He sees the possibility of criticism of TFSAs on the basis that only the wealthy can benefit. A remedy suggested by Prof. There could also be a limit on total lifetime contributions. TFSAs are a very popular program, so there would be a political cost to changes that restrict use of these accounts.

Moreover, with the contribution limit recently lowered by the federal government, TFSAs now appear to be on a sound footing. All you need is an online brokerage account and just three exchange-traded funds — which are cousins to mutual funds that trade like a stock. This million dollar TFSA strategy was suggested by Justin Bender and Dan Bortolotti of PWL Wealth Management.

One is the suggested 75 per cent weighting in stocks, compared to just 25 per cent in bonds.

What investments should you hold in your TFSA? with Gord Pape and Rob CarrickStocks have been mostly terrible in the past 12 months, and there will be more downturns like this to come.

Also, a portfolio heavy in stocks may not be suitable for people approaching retirement.

TFSA vs RRSP: Which one is Better for You? Updated for

A lot depends on whether you also have a pension or other investments with a more conservative mix. You could co cash or guaranteed investment certificates, but the expected returns from stocks looking ahead are higher. By his analysis, someone making maximum contributions for 40 years and earing 5. Follow Rob Carrick on Twitter: Build your own million-dollar TFSA. Rob Carrick These stocks are perfect for your TFSA. This TFSA portfolio is suitable for aggressive investors.

This TFSA portfolio is doing acceptably well despite energy woes.

“Can I buy stock options for my TFSA?” - RE: Investing

Discover content from The Globe and Mail that you might otherwise not have come across. Newspaper delivered to your doorstep. Subscribe to the newspaper. Digital all access pass across devices. Subscribe to Globe Unlimited. The digital replica of our newspaper. Get top Globe stories sent to your inbox. Subscribe to email newsletters.

Get digital access or the printed edition delivered to your door. Subscribe to The New York Times. Globe Unlimited digital edition and Globe2Go e-paper group discounts available. Corporate financial data and content licensing for your organization.

TFSA vs Non-Registered Account

Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. Thomson Reuters is not liable for any errors or delays in Thomson Reuters content, or for any actions taken in reliance on such content.

Globe Investor is part of The Globe and Mail's Report on Business. Selected data supplied by Thomson Reuters. Comments Share via email Share on facebook Share on twitter Share on LinkedIn Print License article. Also on The Globe and Mail. Why millennials should use a TFSA over an RRSP The Globe and Mail.

This TFSA portfolio is suitable for aggressive investors Gordon Pape: News Jared Kushner speaks publicly for first time in White House role Report on Business Carrick Talks Money: Report on Business TIFF Bell Lightbox — more than a philanthropic partnership.

Arts Melanie Mah wins Trillium Book Award. Your daily horoscope Saudi King upends royal succession, names son as first heir Former TDSB director guilty of plagiarizing his PhD, panel says Embattled Sears Canada preparing to seek creditor protection: These CPP rules could be harmful to your financial security. Subscribe The Globe and Mail Newspaper Newspaper delivered to your doorstep. Globe Unlimited Digital all access pass across devices.

Globe2Go The digital replica of our newspaper. Globe Email Newsletters Get top Globe stories sent to your inbox. The New York Times Get digital access or the printed edition delivered to your door.

Globe Corporate Sales Globe Unlimited digital edition and Globe2Go e-paper group discounts available. Learn more Corporate financial data and content licensing for your organization.

Available for download on the following devices iPhone iPad Android Blackberry. Copyright The Globe and Mail Inc. We've run into a glitch. Please try again later.