Option call calendar spread

The long call calendar spread is engineered to allow you to profit from fluctuations in time value. A so-called horizontal spread, the trade involves the sale of a shorter-term call and the simultaneous purchase of a longer-term call, with both options sharing the same strike price.

Bull Calendar Spread Explained | Online Option Trading Guide

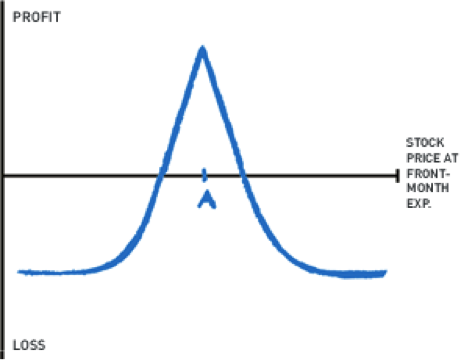

Both trades are closed out just prior to the expiration of the shorter-term option, allowing the trader to capture the remaining time value on the longer-dated call. Since the impact of time value is greatest when dealing with at-the-money options, the stock will ideally remain very close to the strike price of your calls throughout the duration of the trade. In other words, this strategy is best reserved for relatively stagnant equities.

To understand how the long call calendar spread allows you to capture time value, let's look at an example. With no major events on the calendar, and the broader equities market relatively calm, it seems unlikely the stock will make a big move anytime soon.

You decide to construct a long call calendar spread by selling to open the front-month strike call for the bid price of 0. After subtracting your credit of 0. In the best-case scenario, Stock XYZ will be trading squarely at the strike price of your call options when the front-month contract is due to expire. In other words, you're exiting the spread with a net credit of 0. As you can see, your maximum profit is equal to the net credit you receive for closing out the trade, less the net debit you paid to enter the spread.

Since the long call calendar spread relies upon stagnation in the underlying stock, your profit is dependent entirely upon your initial cost of entry and the value of the back-month option at front-month expiration.

Likewise, while there's no hard-and-fast "breakeven" on the long call calendar spread, you'll need to close both trades at expiration for a net credit that's equivalent to your net debit upon entering the trade.

Your maximum loss on a long call calendar spread is equivalent to the net debit you paid to establish the trade. Even if XYZ rallies sharply and you're assigned on the short call, you'll be able to exercise your longer-dated call to meet those obligations. Similarly, if the stock plummets sharply, both calls can be left to expire worthless. Since you're simultaneously long and short two call options at the same strike, your relationship with implied volatility in the long call calendar spread is a little complicated.

Any positive effect on one option will be offset by negative effects on the other option. However, as the front-month contract draws closer to expiration and begins losing value at an accelerated pace, implied volatility changes will have their greatest impact on the longer-dated option.

How to Ensure Success With Options Calendar Spread: 9 Steps

This means you'd prefer to see volatility rise later in the trade's life span, as it will increase the amount you receive by selling to close the longer-term call. The long call calendar spread can be altered to fit a number of different time intervals beyond a one-month gap.

If you do choose to implement a spread with a wider time lapse between expiration dates, you might consider rolling out your short call to the next sequential series at the end of each expiration cycle. This generates additional brokerage fees, but it also puts additional credits in your pocket with the sale of each successive call.

If you expect the stock to rise slightly during the life span of the sold call, you might prefer to use slightly out-of-the-money options to build your spread.

This can lower your cost of entry relative to an at-the-money spread. However, it also requires you to pinpoint a fairly accurate ceiling for the underlying shares. MY ACCOUNT CONTACT US SEARCH.

Option Spread DifferencesABOUT US NEWS AND ANALYSIS TRADING SERVICES OPTIONS EDUCATION BROKER CENTER 30 FREE TRADES. Long Call Calendar Spread Outlook: Expecting minimal price movement; possible bullish skew The long call calendar spread is engineered to allow you to profit from fluctuations in time value. Potential Gains In the best-case scenario, Stock XYZ will be trading squarely at the strike price of your call options when the front-month contract is due to expire. Potential Losses Your maximum loss on a long call calendar spread is equivalent to the net debit you paid to establish the trade.

Volatility Impact Since you're simultaneously long and short two call options at the same strike, your relationship with implied volatility in the long call calendar spread is a little complicated.

Pencil In Profits In Any Market With A Calendar Spread

Other Considerations The long call calendar spread can be altered to fit a number of different time intervals beyond a one-month gap. About Us Trading Services Contact Us Advertise with Us Sitemap Privacy Policy Additional Legal Notice. Unauthorized reproduction of any SIR publication is strictly prohibited.