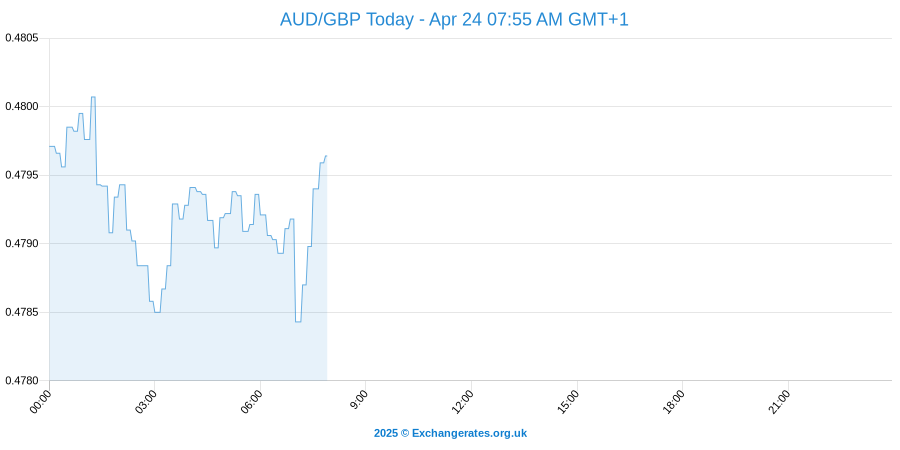

Aussie dollar trading today

The Australian dollar tried to rally during the day, and then turned around to sell off rather drastically. Because of this, the 0. A breakdown below there should send this market down to the 0. Short-term traders can consider this as a good time to sell the pair. The much awaited Brexit negotiations have finally started and the European Union EU leaders have planned to meet on June 22nd to review the recent developments in the talks.

The Australian Dollar is trading nearly flat after the Reserve Bank of Australia released the minutes of its monetary policy meeting in early June. At this meeting, the RBA left interest rates unchanged at a record low 1. The Australian dollar fell slightly during the day on Monday, reaching towards the 0. I think that the slight bounce that showed signs of weakness shows that the market is probably going to reach down to the 0.

Traders will be looking for any guidance regarding plans to raise or lower interest rates. This strongly suggests investor indecision ahead of the release of the Reserve Bank of Australia monetary policy minutes on Tuesday.

It also indicates impending volatility. We could see a reaction today during the U. After the FOMC meeting, the pair shot up and then gradually fell down, before rising higher again. The Australian and New Zealand Dollars are trading mixed early Monday.

Traders are reacting to economic reports and a speech by a central bank official. Last week, the Australian Dollar received a boost in response to a strong labor market. This was more than enough to offset the weakness attributed to the hawkish Fed announcements.

According to the government, the Employment Change report showed the economy added 42, new jobs. This helped drive the Unemployment Rate lower from 5.

The advance by the Australian Dollar was primarily driven by the weakness in the U. The Greenback slipped on weaker-than-forecast data on housing and consumer sentiment. Mixed comments from Fed officials also may have contributed to the U. The Australian dollar rallied during the week, breaking above the 0. This is a very bullish looking market, and I believe that a break above the top of the candle census market looking for the next obvious resistance barrier at the 0.

The Australian dollar shut higher initially during the day on Friday, but then pulled back to test the opening again, only to rally and reach towards the 0. We found a bit of resistance there, so a pullback could be coming. Investors are also reacting to lower government debt prices on Friday morning.

Australian and New Zealand Dollar investors conceded the U. Federal Reserve won the latest round in the battle of Forex supremacy with both currencies losing ground on Thursday. The Australian dollar initially tried to rally during the day on Thursday, but found resistance at the 0.

AUD (Australian Dollar) - Latest News, Analysis and Forex Trading Forecast

We pulled back from there, and then reached for support below where we did start to see that. S CPI and Retail Sales data coming in weaker than expectations, there was a sudden sell-off for the dollar yesterday as traders thought the Fed might take some time and wait for better results before proposing the rate hikes.

Due to this, the market ended up being volatile for a while. Both the Australian and New Zealand Dollars spiked to the upside on Wednesday in reaction to disappointing U.

However, they also pared their gains later in the session after the U.

Federal Reserve came across a little more hawkish than expected. Traders also cut positions ahead of key domestic reports. The Australian dollar exploded to the upside during the day on Wednesday, in anticipation of the Federal Reserve meeting announcement. FX Empire - the company, employees, subsidiaries and associates, are not liable nor shall they be held liable jointly or severally for any loss or damage as link result of reliance on the information provided on this website.

The data contained in this website is not necessarily provided in real-time nor is it necessarily accurate. FX Empire may receive compensation from the companies featured on the network.

All prices herein are provided by market makers and not by exchanges. As such prices may not be accurate and they may differ from the actual market price. FX Empire bears no responsibility for any trading losses you might incur as link result of using any data within the FX Empire. All Brokers Forex Commodities Indices Stocks Loading Home Markets News Forecasts Education Brokers Economic Calendar Trading Signals.

omenejomy.web.fc2.com - Free Currency Charts

Forex Commodities Indices Stocks. Economic News Commodities News Forex News Opinions Brokers News. Expand Your Knowledge Basic Education Advanced Education Live Webinars Financial Glossary Financial Podcasts. Forex Brokers Binary Options Brokers Brokers Bonuses Social Trading How to Choose a Forex Broker Best Forex Brokers.

Signals Performance Days Trial Plan Monthly Subscription Plan 3-Months Subscription Plan Free Signals - Learn How Futures Signals. Overview Technical Forecasts News Chart. TOP BROKERS BY Reviews. ABOUT US PRIVACY POLICY TERMS OF USE CONTACT US ADVERTISE WITH US BECOME AN AUTHOR GET FINANCIAL CONTENT FXEMPIRE'S ARCHIVED POSTS.