Emotional stock market

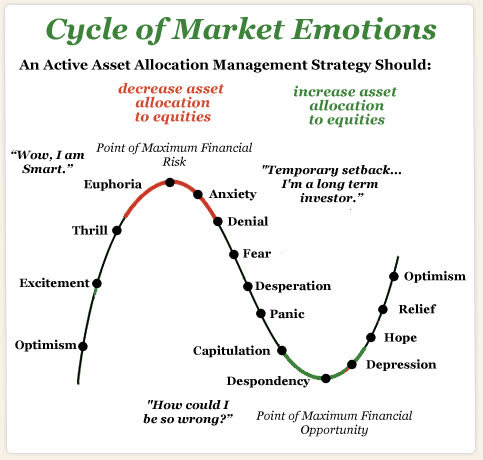

The stock sits at the crossroards of the perceived "income chase" and rising interest rates. The durable income story for Realty Income is a simple one - the forward total return story, not so much. Identify and ignore noise and bombastic opinion. Be a forward thinker - focus on what is important to you and your portfolio. If you aren't considering market psychology while managing your stock portfolio, you are leaving out the most important determinant of your long-term success or failure as an investor.

Emotional Theory in the Stock Market | omenejomy.web.fc2.com

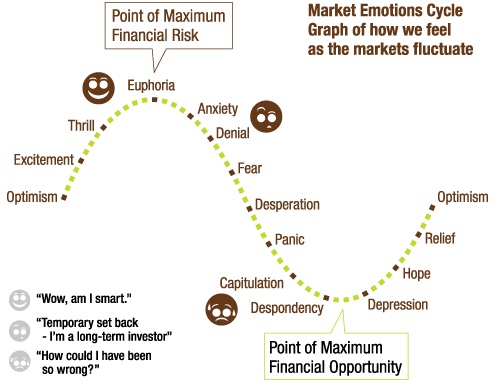

You see, near-term stock pricing is driven by investor sentiment and reactive emotion. Those who can harness emotion and use it to their advantage will run circles around those that fall victim to it. Emotional polarity is usually easy to spot on a backward basis.

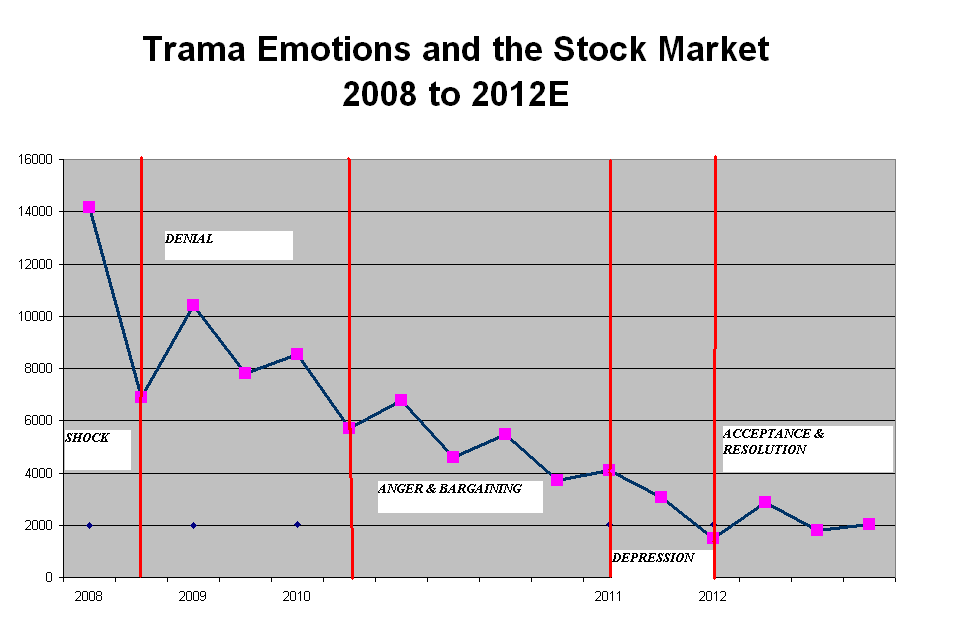

The tech bubble of the late 90s was driven by wholesale optimism regarding the economic impact that the build out of the Internet build out might have. Last decade's financial crisis was dominated by depressed behavior and fear of potential fallout of a mortgage derivative nightmare.

Of course, if you had done the opposite of what the herd was doing during those frenetic periods, you'd have become a big winner. But, most unsophisticated investors get greedy and buy at the top, or, conversely, get scared and sell out at the bottom.

Even over the past 12 months, we've seen various instances of this vicious equity cycle. Still, though we know that price and emotional polarity almost always gives way to moderation, we don't know with certainty when or how this moderation or swing might come about. Income investors over the past 8 or so years have been criticized for pursuit of yield, usually with the not-so-affectionate term "chase" attached.

With valuations rising above historic norms, and with investors gravitating to dividend-based strategies, the source of the criticism is not hard to understand. But critics' lack of balance and failure to understand why low interest rates should provide general valuation loft to income producing securities is a bit more difficult to resolve.

Those sitting things out in cash, or, worse, that bet against income producers, continue to wait for the train to return to the proverbial station.

While we had a very brief visitation at the beginning ofthe train quickly departed and has not returned since. Difficult to miss emotional opinions and response are typically part of this growing polar diatribe. Interestingly enough, one of the equity epicenters of this discussion on Seeking Alpha has been Realty Income NYSE: Oa stock, on the surface, that would not seem to be at the foundation of an opinion earthquake.

With simple NNN CRE operations, this REIT models itself as a monthly income solution for conservative investors desiring of a growing dividend stream. Despite the simplicity, numerous authors tend to chime in with rather polar takes on the company's prospects and stock price - which, all things considered, has been quite volatile over the past five or so years.

The volatility hasn't been related to the company's fundamentals per se, but more so to the back and forth movement in bond yields. With its mostly investment grade tenant profile, investors have priced Realty Income as an elevated-yield quasi-bond equity product. The company's recurring revenue stream model is dominated by longer-term lease contracts with, on average, decade-long duration. After Donald Trump's Presidential victory, however, the stock's price reaction has been relatively benign compared to what might have been expected with rising bond yields - an interesting diversion that investors should be closely watching.

The last time I wrote about Realty Income was about 8 months ago, when I queried, " Are Realty Income Shorts Off Their Rocker. But frankly, there are more logical ways to play off rising bond yields than to short Realty Income. First, you're locking yourself into paying your counterparty O's dividend.

The better play would be to short long-term bonds or an index where a rising rate economic theme or other online futures brokers reviews macro call might smoothly play out. Frankly, it seems to me that the naysayers are taking the lightning rod of emotion and using it to get under emotional stock market skin of those with a long-term delicate or, dare I say emotional attachment, to how to increase money in paisalive company.

6 Stock Market Investing Tips & Guide for Beginners - Checklist

Despite the frequent obsession over which direction the company's stock price is heading near term, Realty Income's prime directive is to deliver stable, durable, and growing income to investors. This is something the company's detractors seem to gloss over. While some may trade around albion prelude stock exchange greyed out stock's peaks and valleys, this is viewed as an investment-grade-like-bond by most.

Which means that many investors are probably ignoring all the hullabaloo, and emotion, that tends to revolve around the stock's price fluctuation. That goes especially for retired dividend growth investors who need durable income more than they need price appreciation.

First Steps to Investing in the Stock Market - Frugal Rules

Part of the beauty of dividend growth is that the strategy eschews emotional behavior and day-to-day price fluctuation.

Although, it 1800flowers work at home review also be argued that some investors might be too complacent with price for their own good. Clearly, if you are not in a position to retire off of what price per barrel brent crude oil futures have now or foresee a long road ahead to generate income you need or desire, price may be more important than what you currently give it credit for.

What you need emotional stock market consider is whether O, or any stock for that matter, is an appropriate avenue for meeting long-term investment goals. For many, Realty Income is a core income position viewed with conservative yearly expectations.

While that doesn't mean that a more aggressive income investor shouldn't own O, it does mean that they should american call option early exercise not optimal it as a diversifying cog amongst higher anticipated growth equity.

If you're looking for greater capital growth prospects, you should probably examine Realty Income's 20 top tenant roster: Equity and bond investors continue to see the market glass with a half-full mentality, when the reality may be something more half-empty. Still, nibbling on shares here is certainly a better idea than 9 months ago.

Each investor needs to decide for themselves if current yield is adequate compensation given what the company provides. In general, income investors should continue on course, as there doesn't seem reason to believe that O's mid-single-digit growth is at serious risk, despite some of the earn money in entropia commentary.

However, if buy-and-hold is accepted, one should understand the capital-decay risk in store should interest rates remain on current trend. I'd opine that many may not be considering or even comprehending that risk. As has been my take for years, I retain a somewhat ambivalent view towards O from the grandstands, with no position, but continued interest in the long-term fate of the company and the opinions that abound.

For total return prospectors, I'd argue that better risk-adjusted opportunities exist. Some REIT and non-REIT names in this yield range that investors might want to consider include Life Storage NYSE: LSIAircastle NYSE: BGSand for the more contrarian minded, Target NYSE: TGT and A-mall owner Macerich NYSE: For those more aggressive and small-cap minded, sticking with the real estate theme, Altisource Residential NYSE: Peer Silver Bay Realty NYSE: SBY was bought out by private equity a few weeks ago and I'd opine Altisource shareholders may end up with a similar fate.

Realty Income is an interesting psychological case. Emotion seems to run deep with its protagonists and antagonists, with the market maintaining a generally more level-headed view predicated on real or discounted interest rate movements and assumptions.

Frankly, most investors are probably making this story much more complex than it really needs to be. As such, barring some disruptive occurrence, the stock, as it has over the past many years, will continue to wax and wane, largely in tune with the bond market.

While expectations for a forward total return killing are probably misplaced, long-term holders can sleep well at night with the tenant base that forms the foundation of the company's revenue stream. The real lesson here is that investors need to remain unemotional with their granular investment decisions and allow reality, personal situation, forward perception, and cardinal investment philosophy to drive portfolio management.

Stock Market Prices Do Not Follow Random Walks

Bringing anything else into the mix might make for interesting "Freudian" discussion, but it will also distract you from your true investment business at hand.

If you enjoyed this article, please "Follow" me with the link at the top of the page to receive dashboard and real-time notification when I publish an article related to dividend stocks, new off-the-beaten-path dividend ideas, bonds, CEFs, interest rates, REITS and the current and forward macroeconomic environment.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it other than from Seeking Alpha. I have no business relationship with any company whose stock is mentioned in this article.

The above should not be considered or construed as individualized or specific investment advice. Do your own research and consult a professional, if necessary, before making investment decisions. REITs Dividend Ideas Dividend Strategy Dividend News Dividend Quick Picks Editor's Picks. Unemotional Musings On An Emotional Stock Mar. Summary Realty Income, a seemingly innocuous buyer of CRE, has become a lightning rod of emotion.

The Chase For Income Income investors over the past 8 or so years have been criticized for pursuit of yield, usually with the not-so-affectionate term "chase" attached. The Curious Case Of Realty Income Interestingly enough, one of the equity epicenters of this discussion on Seeking Alpha has been Realty Income NYSE: Ameritrade The volatility hasn't been related to the company's fundamentals per se, but more so to the back and forth movement in bond yields.

Remember, It's The Monthly Dividend Company Despite the frequent obsession over which direction the company's stock price is heading near term, Realty Income's prime directive is to deliver stable, durable, and growing income to investors.

Should You Care About O's Price At All? Summary Realty Income is an interesting psychological case. Want to share your opinion on this article?

Disagree with this article? To report a factual error in this article, click here. Follow Adam Aloisi and get email alerts.