Cra stock option deduction

Life at Collins Barrow is rewarding on so many different levels both professionally and personally: Where you start your career is one of the most important decisions you will ever make. Many businesses use stock options to attract and reward good employees. If the stock options are structured properly, the employee can enjoy the benefit on a tax-effective basis.

Employees typically receive stock options, granting them the right to purchase shares of the employer corporation at a fixed price the exercise price on a future date. The granting of the stock option does not create an immediate tax event for the employee. A taxable employment benefit is triggered when the employee exercises the options and acquires shares of the company.

The benefit is equal to the amount, if any, by which the fair market value FMV of the shares at the time the employee acquires them exceeds the amount paid by the employee for the shares the exercise price.

Security options

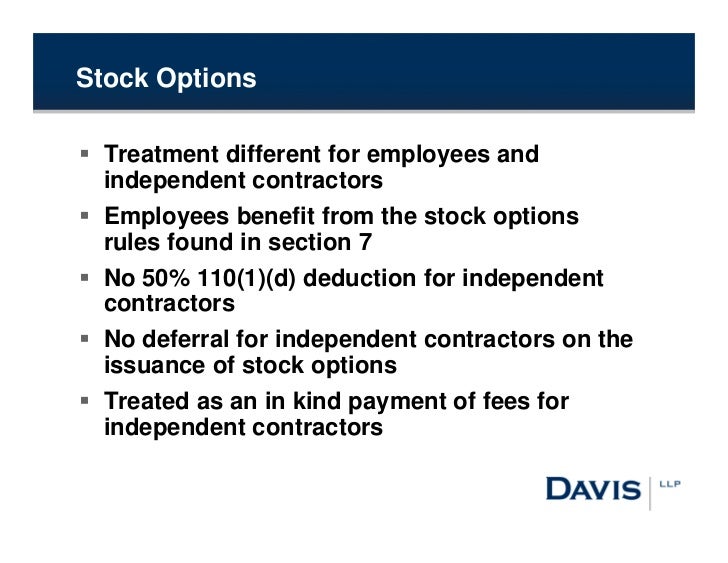

The employee may also be entitled to an offsetting deduction equal to 50 per cent of the amount of the employment benefit if certain conditions are met. The deduction results in the employment benefit being effectively taxed as if it were a capital gain, notwithstanding that the benefit is income from employment. Where the stock option plan provides an employee the choice to receive cash in lieu of shares, and the employee opts to receive cash, the employer is permitted a deduction for the cash payment.

However, the employee may not claim the 50 per cent deduction on the employment benefit amount at the same time unless the employer files an election to forego the deduction on the cash payment. The above rules are even more advantageous when the employer is a Canadian-controlled private corporation CCPC , a private company that is not controlled by any non-Canadian residents or public companies.

Taxation of Stock Options for Employees in Canada

The timing of the taxation of the employment benefit is deferred to the taxation year in which the employee sells the shares, as opposed to the taxation year in which the employee acquired the shares. The employment benefit will be calculated as discussed above. Moreover, the employee may also claim the 50 per cent offsetting deduction as long as the individual holds the shares of the CCPC for at least two years before selling them.

Stock Option Deduction Is Available on Death

There is no requirement that the exercise price be at least equal to the FMV at the date of grant, nor any requirement that the shares qualify as prescribed shares in order to be eligible for the deduction. The tax consequences for Bob depend on whether the issuing company is a CCPC or not:. If the issuing company is not a CCPC, Bob will pay tax on the employment benefit when he exercises his options and acquires the shares in If the issuing company is a CCPC, Bob will not have to pay tax on the employment benefit until he disposes of the shares in Because Bob held the shares for more than two years after the options were exercised, he will also be able to claim a deduction equal to 50 per cent of the benefit.

If Bob had held the shares for less than two years, he would still be able to claim the 50 per cent deduction of the employment benefit since the other conditions are met i. Although the employment benefit is afforded the same tax treatment as a capital gain, it is not actually a capital gain.

Tax Treatment of Restricted Stock Unit (RSU) Benefits | Canadian Capitalist

If you are considering establishing a stock option plan in the coming months, contact your Collins Barrow advisor for more information and guidance. Information is current to October 23, The information contained in this release is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future.

No one should act upon such information without appropriate professional advice after a thorough examination of the particular situation. Rule-focused decisions have kept captives from delivering full value, say Carrie Lam and Steve Prince of Collins Barrow. Canada has over 90 bilateral tax treaties and over 20 bilateral Tax Information Exchange Agreements in force, with at least a dozen more treaties or agreements in the negotiation stage. This fact alone highlights the importance such agreements play on the global tax stage.

Not surprisingly, Canadian multinationals and Canadian subsidiaries of foreign multinationals have long understood the impact tax treaties may have on how their cross-border intergroup transactions will be taxed.

Baker Tilly International is a leading global network of high quality, independent accounting and business advisory firms united by a commitment to provide exceptional client service. Collins Barrow refers to the association of member firms of Collins Barrow National Cooperative Incorporated, each of which is a separate and independent legal entity. Transaction Advisory Services Corporate Finance Estate Trustee During Litigation Restructuring and Recovery Services Transaction Services Valuation Services Other Advisory Services Actuarial Services Business Advisory Services Commercial Insurance Claims Data Solution Services Employee Benefits Consulting Enterprise Effectiveness Forensic Services Human Resource Management Litigation Accounting Services Mediation and Conflict Resolution Operational Performance Reviews and Process Improvement Partnership Disputes Projects and Economics Succession Planning.

Financial Credit Unions Investment Funds Professionals Dental Professionals Medical Professionals. Indigenous Business Services Indigenous Enterprises Indigenous Communities and Not-For-Profits. British Columbia Revelstoke Vancouver Victoria - Downtown Victoria - Westshore Alberta Banff Calgary Canmore Edmonton Red Deer Sylvan Lake Saskatchewan Saskatoon Yorkton Manitoba The Pas Winnipeg.

Ontario Arkona Carleton Place Chatham Clinton Cobden Cochrane Collingwood Durham Region Elora Essex Gananoque Guelph Hearst Kapuskasing Kingston Leamington Lindsay London Meaford Morrisburg North Bay Ottawa Owen Sound.

Careers Get a CB Life Now Life at Collins Barrow is rewarding on so many different levels both professionally and personally: Or select National for a comprehensive, coast-to-coast perspective. Revelstoke Vancouver Victoria - Downtown Victoria - Westshore. Banff Calgary Canmore Edmonton Red Deer Sylvan Lake. Arkona Carleton Place Chatham Clinton Cobden Cochrane Collingwood Durham Region Elora Essex Gananoque Guelph Hearst Kapuskasing Kingston Leamington Lindsay London Meaford Morrisburg North Bay Ottawa Owen Sound Peterborough Sarnia Stratford Strathroy Sturgeon Falls Sudbury Timmins Toronto Vaughan Walkerton Winchester Windsor.

Tax Alert NPO Alert Farm Alert Indirect Tax Alert Lawyers Alert On The Mark Infographic Budget Reports Insights Business Interruption Capital Markets Credit Unions Technical Bulletins and IFRS. Tax Transaction Advisory Services Corporate Finance Estate Trustee During Litigation Restructuring and Recovery Services Transaction Services Valuation Services Other Advisory Services Actuarial Services Commercial Insurance Claims Data Solution Services Employee Benefits Consulting Enterprise Effectiveness Forensic Services Litigation Accounting Services Operational Performance Reviews and Process Improvement Partnership Disputes Projects and Economics Succession Planning.

March 9, - Views by Maria Severino , Marlin Miller Budget Reports. February 27, - Views by Altaf Sarangi Tax Alert. February 24, - Views by Chris Brennan Tax Alert.

Total income inclusion to