Doji forex indicator

The Dynamic Doji - A Clear Trend Reversal Signal

Gold Prices May Find a Lifeline as Market Mood Darkens. Loonie Slides as Crude Dives- USDCAD Recovery Eyes Resistance. FTSE Further Develops Range on Sharp Turn Lower. Dow Jones Industrial Average Struggles to Hold the Gap Higher. The British Pound Breakdown. But in fact, the doji by itself represents indecision in the marketplace.

The lowly doji is very unassuming in appearance. These small candles can lead to large breakouts that either continue trends or reverses them. We are going to look at the way to trade these power packed price patterns with limited risk for maximum potential gain. Typical candlesticks consist of a body that may be one of two colors; blue or red. A candle is blue if buyers were able to push prices above the opening price and were able to hold it until the close of the candle.

A candle is red or bearish is sellers were able to push prices below the opening price and hold it there until the close. On the other hand, the doji candles have no color. The doji and long-legged doji illustrate the battle between buyers and sellers that ended in a tie.

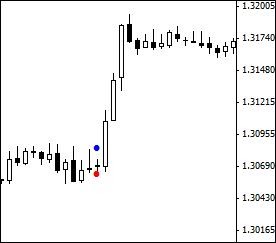

The opening price and closing price are in the same place as bulls were unable to close prices higher and bears were unable to close prices lower. Ideally, you want to find a doji that has formed near a level of support like a trend line.

You want to identify the doji high and the doji low as this will determine the support and resistance levels of a potential breakout.

Doji Candlestick with Bollinger Bands Are Good Trading Tools

Next, you want to wait for a full-bodied candle to close either above the doji high or below the doji low. Since bulls and bears have been at a standstill, a high volatility breakout should happen releasing this pent up pressure.

If you get a breakout below the doji low, place a protective stop about 4 pips above the doji high and enter short on the close of the breakout candle.

Calculate the doji range and multiply that times two to get the limit. Since your stop is the range itself, you want to target double your initial risk. On the other hand, if a full-bodied candle closes above the doji high, enter long at the close of the candle and place a stop 4 pips below the low of the doji.

That is your trigger to get long. In the example above, the doji range was 20 pips and twice the range gave me a target of 40 pips.

Notice how significant the high of the doji was as it acted as support. It is important to note that some dojis during periods of low volatility, like those found in the Asia session, give many false signals.

So next time you see the doji on your forex charts, give the little fella some respect as it can tell you a lot about setting stops and limits for the next big breakout trade! Follow me on Twitter gregmcleodtradr. I hope you learned how to spot breakout trades with the doji Japanese candlestick pattern as well as rules to trade doji breakouts. If you are new to candlestick charting or want to further your knowledge of candlestick patterns.

Sign my guestbook to access a short 20 minute free tutorial Price Action Candlesticks by clicking here. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Market News Headlines getFormatDate 'Wed Jun 21 Technical Analysis Headlines getFormatDate 'Wed Jun 21 Education Beginner Intermediate Advanced Expert Free Trading Guides.

News getFormatDate 'Wed Jun 21 News getFormatDate 'Tue Jun 20 News getFormatDate 'Mon Jun 19 How to Trade the Forex Doji Breakout getFormatDate 'Thu Oct 03 Upcoming Events Economic Event.

Forex Economic Calendar A: NEWS Articles Real Time News Daily Briefings Forecasts DailyFX Authors. CALENDAR Economic Calendar Webinar Calendar Central Bank Rates Dividend Calendar.

EDUCATION Forex Trading University Trading Guide. DAILYFX PLUS RATES CHARTS RSS. DailyFX is the news and education website of IG Group.