Foreign currency and currency exchange rates irs

Bureau of the Fiscal Service

You must express the amounts you report on your U. Therefore, you must translate foreign currency into U.

In general, use the exchange rate prevailing i. The only exception relates to some qualified business units QBUs , which are generally allowed to use the currency of a foreign country.

If you have a QBU with a functional currency that is not the U. A taxpayer may also need to recognize foreign currency gain or loss on certain foreign currency transactions.

See section of the Internal Revenue Code and the regulations thereunder. Internal Revenue Service IRS in U. The Internal Revenue Service has no official exchange rate.

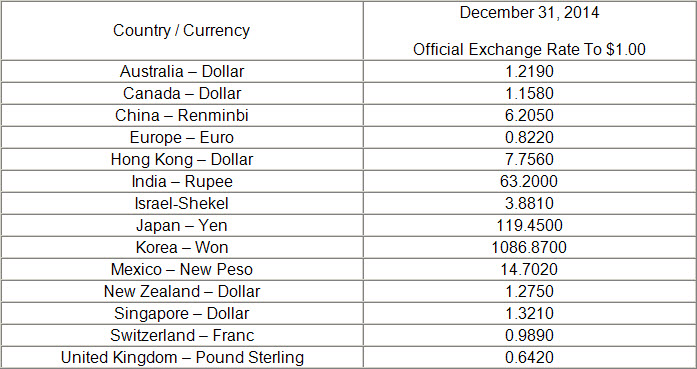

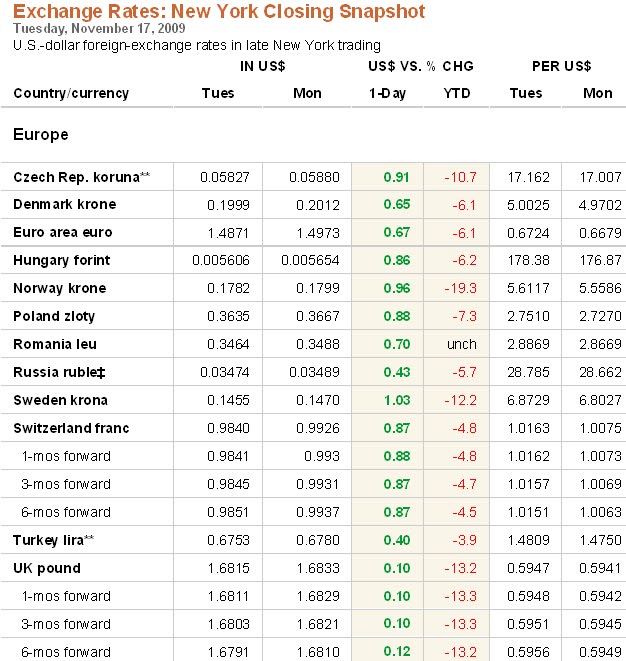

CFA Level I- 2015 -Economics : Currency Exchange RatesGenerally, it accepts any posted exchange rate that is used consistently. When valuing currency of a foreign country that uses multiple exchange rates, use the rate that applies to your specific facts and circumstances. The exchange rates referenced on this page do not apply when making payments of U.

If the IRS receives U. For additional exchange rates, refer to Foreign Currency and Currency Exchange Rates.

To convert from foreign currency to U.

To convert from U. Subscriptions IRS Guidewire IRS Newswire QuickAlerts e-News for Tax Professionals IRS Tax Tips More. Know Your Rights Taxpayer Bill of Rights Taxpayer Advocate Accessibility Civil Rights Freedom of Information Act No FEAR Act Privacy Policy.

Treasury Treasury Inspector General for Tax Administration USA.