Using interest rate parity to trade forex

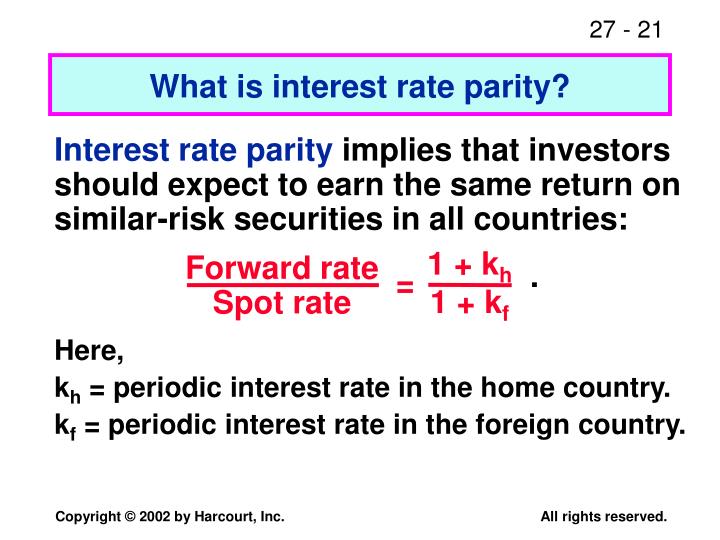

Covered interest rate parity refers to a theoretical condition in which the relationship between interest rates and the spot and forward currency values of two countries are in equilibrium. Additionally, the covered interest rate parity refers to the situation in which the no-arbitrage condition is satisfied with the use of forward contracts.

As a result, there are no interest rate arbitrage opportunities between those two currencies. The condition also states that investors could hedge foreign exchange risk, or unforeseen fluctuations in exchange rates, with forward contracts.

What Is Interest Rate Parity Theory?

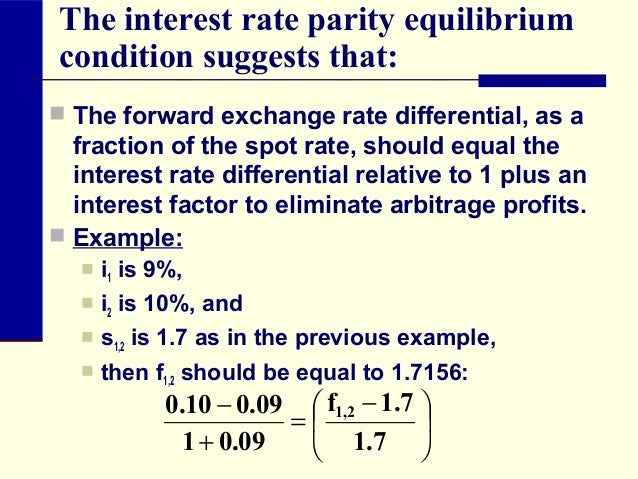

Consequently, the foreign exchange risk is said to be covered. Under the covered interest rate parity, the following formula must hold true, otherwise there would be an arbitrage opportunity: Under normal circumstances, a currency that offers lower interest rates tends to trade at a forward foreign exchange rate premium in relation to another currency offering higher interest rates.

All other things being equal, it would make good sense to borrow in the currency of Z, convert it in the spot market to currency X and invest the proceeds in Country X. However, to repay the loan in currency Z, one must enter into a forward contract to exchange the currency back from X to Z. Covered interest rate parity exists when the forward rate of converting X to Z eradicates all the profit from the transaction. Since the currencies are trading at par, one unit of Country X's currency is equivalent to one unit of Country Z's currency.

Assume that the domestic currency is Country Z's currency. Therefore, the forward price is equivalent to 0. Dictionary Term Of The Day.

A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

FX Forwards

Covered Interest Rate Parity Share. What is 'Covered Interest Rate Parity' Covered interest rate parity refers to a theoretical condition in which the relationship between interest rates and the spot and forward currency values of two countries are in equilibrium.

Formula Under the covered interest rate parity, the following formula must hold true, otherwise there would be an arbitrage opportunity: Interest Rate Parity Forward Premium Covered Interest Arbitrage Uncovered Interest Arbitrage Currency Forward Parity International Currency Exchange Foreign Exchange Outright Forward.

Secrets of trading forex now disclosed

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.