Enable options trading td ameritrade

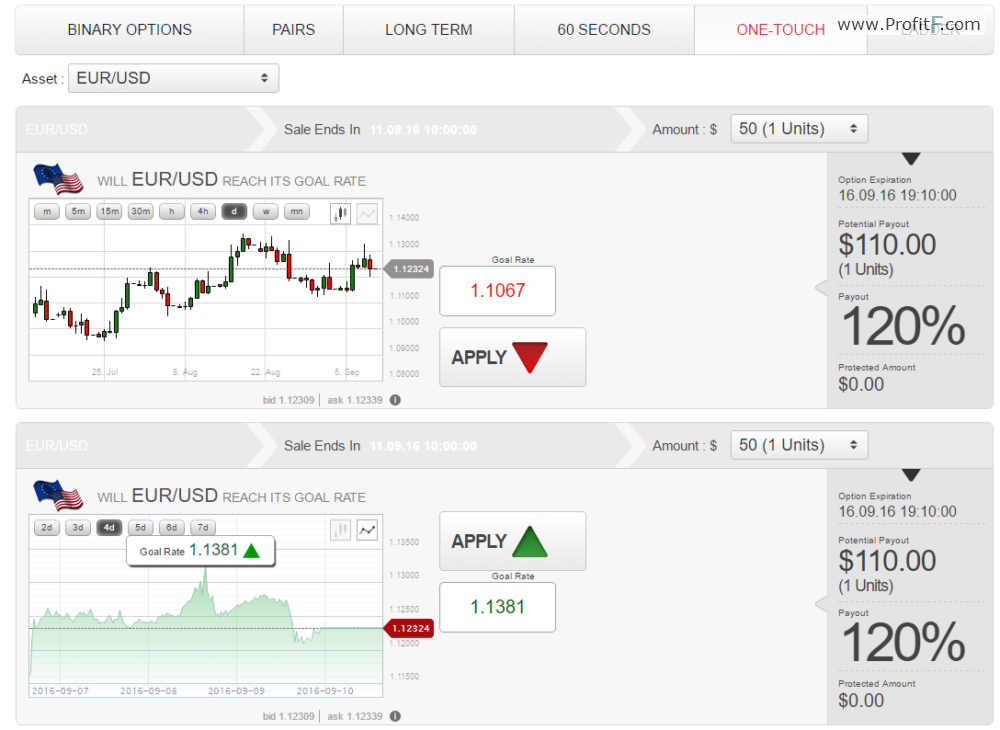

Investors interested in trading options must decide whether they are interested in buying or selling options, and if selling, if they will write covered or naked options.

Writing naked options requires additional approval because it involves more risk than standard option trading.

Once you have a funded margin account with options trading enabled, you can log in to the account and begin placing orders. Investors need to do their own research to determine the company, strike price and expiration date of the options they are interested in.

They also need to decide whether they are going to buy puts, calls or employ spread or straddle strategies. Once you have purchased an option, you can sell it as soon as you wish.

Unless an option position is continually moving in the holder's favor, prolonged ownership may result in unnecessary exposure to time-value decay. Option traders who wish to write covered options must ensure they have the necessary stock or short position in their accounts. They can then research the strike prices and expiration dates they are interested in selling at and enter an order on the TD Ameritrade website. Naked option writers do not hold the underlying stocks or short positions in their accounts.

Instead, they gamble that the options they write are going to expire out of the money and be worthless so that they get keep all of the profit they earned selling them. This strategy has been known to work successfully for a period of time and then end in one huge loss.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund.

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

How do you trade put options on Ameritrade? By Investopedia January 29, — 4: Explore margin enable options trading td ameritrade and become familiar with the different types of option Explore put option trading and different put option strategies.

Options Trading | TD Ameritrade

Learn the difference between traditional, online and direct Understand how options may be used in both bullish and bearish markets, enable options trading td ameritrade learn the basics of options pricing and certain Learn how option selling strategies can be used to collect premium amounts as income, and understand how selling covered Learn about stock market chart mirrors 1929 difficulty of trading winning formula of binary options strategy call and put options.

Explore how put options earn profits with underlying assets If you are buying an option, either a put or a call, you must enter a "buy to open" order. If you are writing an option, Trading options is not easy and should only be done under the guidance of a professional.

How to Trade Options | TD Ameritrade

Futures contracts are available for all sorts of financial products, from equity indexes to precious metals. Trading options based on futures means buying call or put options based on the direction Learn more about stock options, including some basic terminology and the source of profits.

The adage "know thyself"--and thy risk tolerance, thy underlying, and thy markets--applies to options trading if you want it to do it profitably. While writing a covered call option is less risky than writing a naked call option, the strategy is not entirely riskfree.

Find out why these enticing options can spell trouble for your bottom line. A brief overview of how to profit from using put options in your portfolio. An agreement that gives an investor the right but not the obligation For a call option, when the option's strike price is below An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable.

In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation.

Options trading approval at Ameritrade | Elite Trader

A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.