Option period earnest money

Although every real estate market is different, buyers and sellers typically follow agreed-upon protocols during the delicate pre-closing dance.

What is the deadline for your buyer to pay an option fee? | Advice for Texas REALTORS® | Texas Association of REALTORS

Option fees and earnest money payments are key aspects of this dance. Since they're relatively small and may be governed by arcane, little-invoked rules, folks on both sides of a property transaction often pay them less heed than they deserve. Before you jump into a purchase or sale contract, butch up on the key differences between option fees and earnest money payments. The latest eBook from CourthouseDirect.

Click on the cover above to download your FREE guide today!

Site created and maintained by CourthouseDirect. Posted on Fri, Nov 22, What Is an Option Fee? Although it's not a hard-and-fast requirement, the option fee is included in most real estate transfer contracts.

The purpose of the option fee is to provide a harried buyer with enough time to arrange safety and code inspections of the property that he or she intends to buy. It typically gives the buyer the right to cancel the pending transaction within a day window.

Since option fees are generally paid "over the table" and immediately deposited by sellers, they're rarely refunded. Exceptions to this rule must be codified in the transfer contract before the payment of the option fee.

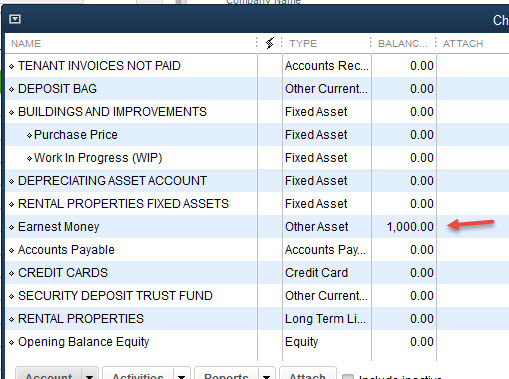

What Is Earnest Money? Earnest money payments are larger deposits that are generally held in escrow until closing. A given earnest money deposit's value will fluctuate in accordance with the vicissitudes of the housing market and the purchase price of the parcel. Generally speaking, it will exceed the value of the parcel's option fee by at least a factor of In frothy housing markets, earnest money deposits of 3 percent of the home's list price aren't out of the question. While many earnest money payments are refunded after closing, others are not.

These issues must be worked out during the drawing-up of the transfer contract. Key Differences Aside from the obvious difference in size, these two types of pre-closing payments differ in a few other respects.

First, option fees are almost always deposited in an account that's controlled by the seller. By contrast, earnest money is usually held in escrow by a real estate agent or bank. While option fees aren't typically refunded, it may be possible for buyers to secure a refund pledge in particularly slow real estate markets. Earnest money payments are refunded far more regularly. Finally, option fees only confer unrestricted cancellation rights during the agreed-upon period of applicability.

Under limited circumstances, earnest money payments may confer cancellation rights after the applicability period. Such circumstances might include: The discovery of lead paint in a pre home after a third-party inspection or legal disclosure The buyer's inability to procure full financing during a pre-closing financing period that typically lasts for 30 days The introduction of HOA documents that reveal unexpected obligations or restrictions for the buyer Refund Protocols In general, option fees aren't eligible to be refunded.

Since they're relatively small and accrue directly to the sellers who demand them, this isn't usually a deal breaker for buyers. For buyers who won't accept contracts that fail to provide for non-refundable option fees, sellers may be amenable to pro-rating the closing costs accordingly. However, all bets are off after the option period's expiration. Earnest money deposits are refunded or pro-rated on a regular basis. Generally speaking, buyers that withdraw from purchase contracts after discovering undisclosed structural flaws or other serious issues are entitled to full refunds.

Buyers who withdraw on their own account may be eligible for partial refunds. The precise terms of earnest money refunds are decided on a contract-by-contract basis.

Home Buying: Option Money: Terminating a contract after reading seller's disclosure - Trulia Voices

Refunds are generally issued as closing-time discounts. Download The Landman Survival Guide.

What is a Real Estate Option Period

Subscribe to Our Blog! Latest Posts Fun Facts About the Harris County Courthouse WEBINAR: Find the Assessed Value of a Home How Do I Get a Copy of a Quitclaim Deed? What are the Features of a Title Plant? Performing an Online Title Search Using Public Records to Find Lien Information What Is Right of Survivorship and Why is it Important?

The Importance of Historical Data. Posts by category Courthouse Documents 58 CourthouseDirect.