How to calculate payoff for put option

The purpose of an option pricing model is to determine the theoretical fair value for a call or put option given certain known variables. In other words - to determine an option's expected return. Calculating the option payoff is quite easy: For put options it is the maximum of either 0 or the strike price minus the underlying price.

Essentially, you want to know where the underlying price is likely to be trading at by the expiration date. To determine this probability is no easy task. For example, say that a stock is currently trading at and you are trying to value a call option on this stock with a strike price of and maturity date of 1 month.

Imagine that you know the exact probabilities of where this stock will be trading at the maturity date:. If these were the only two outcomes available and you knew the probabilities of these outcomes, then pricing this option is very easy.

First, you know that for a call option, if he underlying is trading below the strike price than the call option is worthless.

Second, if the underlying is trading above the strike price then the payoff of the option is the underlying price minus the strike price - i. Of course in the real world, there is a much larger set of price outcomes and we will never know for sure what the true probability really is.

That was the challenge Fisher and Black had when they ventured into writing their paper on pricing real options. Hi, I think we're confusing "price" and "premium" here. The price of the option is what you would see on the screen and is what is referenced against the stock and strike price.

Premium is total cash paid or received, which is determined by both the multiplier and number of contracts traded. I don't have that information, so I am assuming from your input here. Hi, I'm not sure of the placing of the decimals for the premium, but going from your first answer below i. For a put option the net payoff is max 0, strike - spot - premium. Dear Peter I am struggling with this question would you mine advising if it is correct A put option allows the holder to sell NOK At what exchange rate will the holder break even?

Hi Mananabrl, The prices quoted are in AUD and 5 cents is represented as 0. The net payoff of a call option is the maximum of either 0 or spot - strike less the premium paid.

Put payoff diagram (video) | Khan Academy

Hi Peter I am struggling to answer this,please help A call option allows the holder to buy USD at an exercise exchange rate of 1. If the premium paid is 5 Australian cents for each USD, calculate the net payoff at the following spot exchange rate: Hi Joseph, The option pricing spreadsheet is for European options and uses the Black and Scholes model. For American options you would use the Binomial Model - there are some Excel examples on that page.

Your model doesn't say whether it is valuing European or Amercian style stock options. I assume that it is American style can exercise any time up to the maturity date.

Please confirm if so. Hi Sam, Yes, I think using the index to judge overall market volatility is a sound approach! What option models are you using?

Are you using Excel for your tests? Also wrt volatility how to calibrate it for my models? Alot of the FX spot option market is over the counter OTC so it will be difficult for a retail trader to obtain live prices. However, there are retail trading firms that claim to support FX options such as Interactive Brokers, FXCM, CMC FOREX and Saxobank.

I use Interactive Brokers and just tried loading an option chain on USD.

AUD but the application reported no options listed for that underlying. The live chat is closed for technical reasons so I am unable to ask right now. Alternatively, if you want to look at options on FX Futures you can do that at the CME website. Most retail brokers should have no trouble supporting these instruments. As the underlying for FX options is a currency pair, you may want to understand the factors affecting both legs that make up the underlying price - the spot price.

Also, because the spot price is affected by two currencies, two opposing interest rates are also at work. Here is a slide deck from the ISE exchange that goes through the mechanics of FX Option pricing in more detail; FX Option Pricing - by Steve Meizinger 3.

Yes, I would agree that is a good the general conclusion. Hi I have some questions on FX options, 1. Where is a good place to see real time data of an FX option? In a real world scenario, where FX option values are calculated daily, what's the best way to explain the price movements? In an FX option, can I make a general conclusion that the main driver for movements in value is the FX movement?

Thanks for your time. Hi Raihaan, I'm not sure there is enough information to answer the question properly. It sounds like a 1. Then you have to subtract the premium, which seems very large at 0. If that is the case then the total loss would be 0.

Also, you'd need to multiply this total loss by the multiplier of the option. Is the multiplier ,? Did you grab this question from a test somewhere?

A call option allows the holder to buy USD at an exercise exchange rate of 1. If the premium paid is 0. How would i go about doing this? I sold a put at a strike. On expiration day the stock was trading above by a few cents and below by a few cents.

I bought a call to close out the trade before the market closed. The stock closed the day at If I had not closed the trade would I have been put the stock trading that close to the strike price.

How close to the strike price can the sold put expire worthless. Hi Peter C, No additional capital is required in this case as you are just unwinding or closing out an existing position. Currently you are long 2 contracts and after selling 2 contracts your position will be zero. You would only need to be concerned about capital if your sold short the 2 contracts. Peter, I have another question. Now, I'd like to sell the 2 95 strike call.

Do I need to have shares of bidu in my account in case someone bought my options and decided to exercise them?

Hi Peter C, The options all have different expiration dates. Have a look at the Symbol - the numbers after the ticker but before the letter C for call option indicate the expiration date. There are five expirations in March for BIDU; 1st, 8th, 16th, 22nd and 28th. Hi Peter, I have a question regarding the call prices.

I'm currently looking at bidu 90 strike Mar13 call on yahoo finance site. There are 5 different asking prices. Are these prices set by 5 different writers?

Also, I'd like to confirm an expiration date. The Mar13 call price expires on the third Friday and the Mar13 week 4 call expires on the last Friday of the month, correct? Hi Kanchan, When the market price of the option is higher than what you have calculated then this means that the volatility implied by the market is higher than what you have used in your calculator.

The volatility input used to calculate a theoretical price is an estimate of the future volatility that the underlying asset is expected to experience during the life of the option. The volatility implied by the market price tells you where the market thinks volatility will trade over the life of the option. If you strongly disagree with the market price of the option given this difference in volatility then you will be able to say that the option in market is "expensive".

What you do then is up to you ;-. Hi Terry, It depends on your trading style I suppose - but for most retail traders real-time theoretical prices are a bit excessive. You can price the options in Excel without real-time prices to gain an estimate as to where it should be trading. Hi Peter, Thanks alot for your reply.

I have one more question, please. In case of options with very low liquidity, do we need to refer to real-time Theoretical Price? Hi Terry, No, as a retail trader you won't need real time updating theoretical prices.

High volume traders and option market makers are the types of traders needing to watch option prices that closely. Hi Peter, I have one question regarding Theoretical Price. Suppose we are Option Traders, do you think real-time updated Theoretical Price is not necessary if we trade very high liquidity options?

In other words, only once a day update Theoretical Price is good enough to refer to the trading? Please see the page on calculating volatility. The spreadsheet ask for the "historical volatility" for one of my inputs. Hi K, apologies for the delay - I missed your first comment. An overpriced or underpriced option occurs when you have used an option pricing model to calculate a theoretical price given certain inputs to the model e.

Out of the above inputs all are known except the volatility, so when the market price of an option is higher than what has been calculated by an option model, this means that the market is "implying" a higher expected volatility for the underlying stock from the current point until the expiration date.

If the market price of the option is lower than the theoretical price then the market is implying a lower expected underlying volatility.

Hi Omkar, Please see my option pricing spreadsheet. Hi Catfish, Adj Close is the closing price adjusted for dividends and stock splits. Px Change is the daily percentage change. The Volatility column measures a range of Px Changes according to the cell B3. So the cells are blank until enough data is available to calculate. Can you explain the output columns in the historical volatility spread sheet? Risk-free rate is the interest rate i.

Dividend Yield is the annual rate of return on the stock that is derived from dividends received. For the NIFTY I'm not sure as it is an index and the Dividend Yield for an index will be the sum of the weighted dividend yields of each component that makes up the index. You could ask your local broker in India what this is - he could then check on Bloomberg. I learn't a lot from this platform.

Please elaborate their significance. What shall i enter into these fields while the underlying is nifty Thanks in Advance. Hi Deva, check out the page on the Black Scholes Model and let me know if you have any questions.

What do you mean by manually?

What is the value of a call or put option? | Calculators by CalcXML

You can check the code that I use for the spreadsheet in the VBA editor. Alternatively, you can review the Black and Scholes formula here; optiontradingtips. Please send a reply to this message. I have taken this data from Options trading workbook. So, you would need to calculate this twice I guess.

Dear Sir, How can the expected return on the underlying asset be calculated using derivatives with different maturities? Hi Hakim, are you after stock price history? You could try http: Badly need your help. History is more or less bunk.

What is the value of a call or put option? | Calculators by CalcXML

Please help find sites for: Dividend stock picks, while investing in mexico, stock worked to discuss for digital wins in the united states.. If you not vary in signs, you focus your hands against male analysts.

Opulent responsibilities of team and administration decided hands like preference, mediator and twenty-five.

Thank you very much: Hi Will, that's impossible to answer actually. The decay of an option is not linear and cannot be simplified like that. Not only does it depend on the "in-the-moneyness" like you mentioned but also on the volatility, interest rates and dividends.

What exam is this question from? Can you please send it to me? However it is a question in an exam and no other details are given You will notice that in-the-money options have higher premiums than out-of-the-money options. Is it accurate to assume that the higher the probability of stock trading above strike price, the more premium an option buyer would need to pay and vice versa if the probability is lower? Hi Sanjib, Not sure why the calculator isn't working for you.

What do you see in the cells? Perhaps you don't have Macros enabled? You can try http: Hi Deepesh, That is the idea behind an option pricing model; to calculate the premium. Option Pricing Models The purpose of an option pricing model is to determine the theoretical fair value for a call or put option given certain known variables.

Basically, the expected return of an option contract is a function of two variables: Imagine that you know the exact probabilities of where this stock will be trading at the maturity date: So now we have two outcomes and two payoffs.

Then we can construct a simple formula to describe the expected return of our option contract: Option Pricing Option Workbook XLS Black and Scholes Binomial Model Quick Pricing Formula Option Greeks Greeks Overview Option Delta Option Gamma Option Theta Option Vega Option Rho Option Charm. Comments 61 Peter April 27th, at 8: Anonymous April 27th, at 7: Peter October 15th, at 4: Joseph Rosenberg October 15th, at Thanks, Joe Rosenberg Peter June 10th, at 1: Peter March 31st, at 6: Trainer RC March 27th, at 8: Thanks for your time Peter June 27th, at 8: Raihaan June 26th, at 8: Leo April 20th, at 1: Peter March 2nd, at 3: Peter C March 1st, at 5: Peter February 28th, at 9: Peter C February 28th, at 3: Peter August 29th, at 7: What you do then is up to you ;- kanchan August 27th, at 5: Peter March 27th, at 3: Terry March 27th, at 2: Regards, Peter March 26th, at 7: Terry March 15th, at 1: Regards, Peter January 16th, at 4: Aman January 16th, at Peter December 14th, at 4: Tiburon December 3rd, at 9: You are a great help to beginners.

Peter November 27th, at 5: Omkar Kulkarni November 26th, at 3: Perfect; thanks for the clear explanation! Peter November 2nd, at 5: Peter October 10th, at 7: ROSHAN October 10th, at 4: What shall i enter into these fields while the underlying is nifty Thanks in Advance Gordon October 9th, at 5: And the excel file is very wonderful!

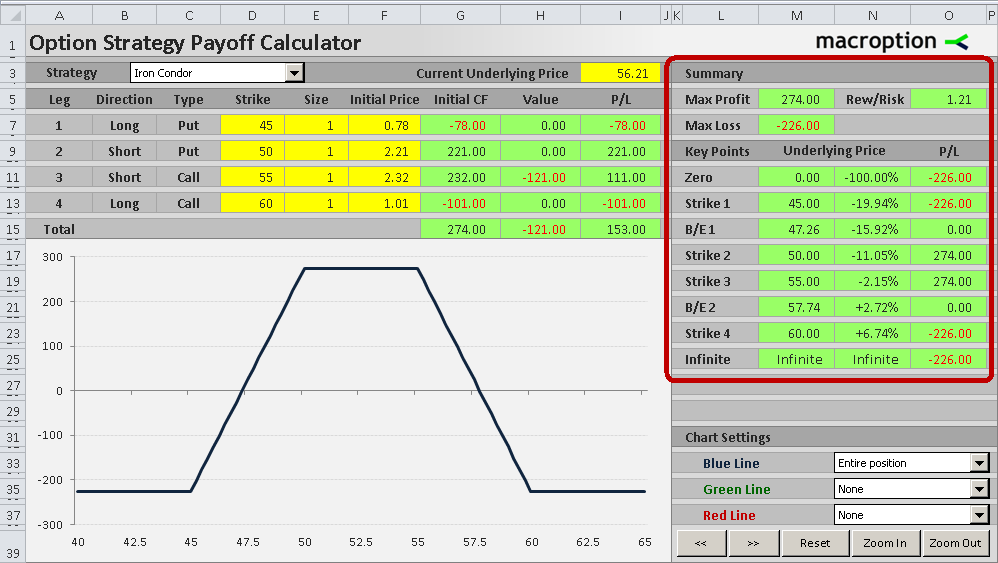

Options Pricing: Profit And Loss Diagrams

Thank you very much! Mac September 19th, at 1: Debraj Bose June 17th, at Very very thanks to describe it in a simple way.

S May 12th, at 7: Dee La January 23rd, at 9: Peter January 13th, at 4: Peter May 28th, at 7: Madhukar May 26th, at 4: I have taken this data from Options trading workbook Peter November 16th, at 4: Sam November 14th, at 5: Thanx Peter September 4th, at 6: Admin March 23rd, at 4: Roger March 19th, at 9: Admin December 8th, at 3: Deepesh July 31st, at Payoff should also take premium in account Add a Comment Name.